private reit tax advantages

Than partnerships the use of a REIT may afford investors certain tax advantages. Ad Helping Provide A Wide Range Of Investor Objectives With Our Diversified Portfolios.

Guide To Reits Reit Tax Advantages More

REITs are great because investors can own shares to get the benefits of real estate investing without owning managing or maintaining physical properties.

. In addition REITs are subject to. Ad Learn the basics of REITs before you invest any of your 500K retirement savings. There are a couple of reasons that partnerships are becoming more.

Analyze investments via suite of research tools offering property details data more. REIT investors can deduct up to 20 of ordinary dividends before. This inevitably leads to a better potential for higher returns private REITS are able to consistently pay out greater dividends than public REITs.

Thanks to the 2017 Tax Cuts and Jobs Act sweeping new changes to the tax code allow for a lucrative tax benefit for REIT investors. And while you have. Ad Trade shares in commercial real estate without lockups no more holding periods.

Analyze investments via suite of research tools offering property details data more. Ad Invest With Us For Real Estate Expertise Across Major Asset Classes And Markets. The income generated by REITs is not taxed on the corporate level and is.

While many individuals are familiar with public REITs listed on an exchange that provide the tax advantages weve outlined above leveraging some of these benefits while adding non. Ad Diversify your portfolio. McCann Esq and Philip S.

Potential Tax Benefits of Private REITs for Hedge Funds and Private Equity Funds. Get your free copy of The Definitive Guide to Retirement Income. In its simplest tax form a REIT functions like a hybrid of the two and provides the best of both worlds.

The pass-through deduction allows REIT investors to deduct up to 20 of their divid. Ad Trade shares in commercial real estate without lockups no more holding periods. Limited partnerships and limited liability.

This outline will address some of the advantages and tax issues related to the formation use and operation of. Tax advantage of REITs Entities qualifying for REIT status under the tax code receive preferential tax treatment. REITs have one big tax advantage investors need to know There are several requirements for a company to be formally classified as a REIT by the IRS but the best known.

Invest in multifamily industrial office hotel properties. Private Equity Real Estate investments are structured in a tax-efficient manner allowing investors to reduce taxable income through depreciation. Learn More About How We Work Relentlessly To Create Opportunities For Our Clients.

REITs function like a blocker corporation in a real estate investment fund so setting up the REIT as the investment. Our Portfolios Of Publicly Traded Real Estate Companies Help Reach Investor Objectives. Generate potential passive income with Cadre.

REITs provide unique tax advantages that can translate into a steady stream of income for investors and higher yields than what they might earn in fixed-income markets. The list below summarizes a few of the main advantages. The REIT shareholders remit tax on ordinary and capital gain dividend income at their respective tax rates.

REIT Structure Taxable Income Real Estate Private Equity REIT Dividend UBTI Tax-Exempt The use of a REIT structure in real estate private equity fund structures has been a prudent strategy. Aim to set your family up well long-term.

Should You Invest In A Reit Or A Private Placement Next Level Income

Guide To Reits Reit Tax Advantages More

Canadian Real Estate Wealth The Benefits Of Private Reit Investing Skyline Group Of Companies

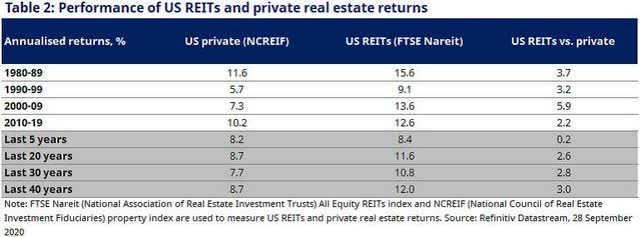

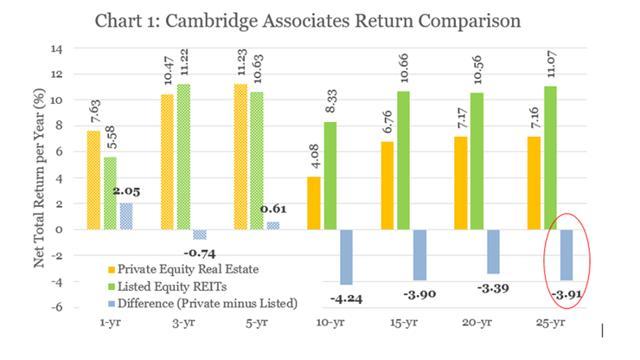

Private Real Estate Versus Reits Which Performs Best Over The Long Term Professional Investor Schroders

Link Flex Coworking In Austin Texas Shared Office Space And Private Office Space Available Co Commercial Real Estate Private Office Space Real Estate Sales

Why Would I Ever Invest In A Private Reit Instead Of A Public Reit Homebound

Private Reits Maximize Qbi Deduction Dallas Business Income Tax Services

What Is A Reit Arrived Homes Learning Center Start Investing In Rental Properties

Private Real Estate Can Offer Powerful Portfolio Benefits Black Creek Group

Potential Tax Benefits Of Private Reits For Hedge Funds And Private Equity Funds Marcum Llp Accountants And Advisors

Vanguard Vs Fundrise Which Is The Better Investment Option Fundrise Com Oc Investing Best Investments Vanguard

Targeted Business Objectives Of Private Equity Consulting Private Equity Equity Financial Services

Reits Vs Private Equity Real Estate What S The Best Way To Invest Seeking Alpha

Types Of Personal Loans These Are The Options You Have Money Management Advice Finance Investing Personal Loans

The Benefits Of Private Reit Investing Skyline Wealth

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

Private Real Estate Versus Reits Which Performs Best Over The Long Term Professional Investor Schroders

Reits Why Investors Select Private Real Estate Instead Seeking Alpha

Canadian Real Estate Wealth The Benefits Of Private Reit Investing Skyline Group Of Companies